Understanding what drives mortgage rates can be crucial for potential homebuyers and those looking to refinance. Mortgage rates fluctuate regularly, sometimes even multiple times per day, affecting affordability and purchasing power for millions of Americans. These interest rates are determined by a complex interplay of economic factors, market conditions, and monetary policies that work together to set the baseline costs for home loans.

The relationship between mortgage rates and broader economic conditions is intricate. When you’re shopping for a mortgage, you’ll quickly discover that interest rates are primarily driven by investor demand in the bond market, particularly for mortgage-backed securities. Mortgage lenders must offer competitive rates to attract borrowers while ensuring they can sell these loans to investors who view mortgages as fixed-income investments with an expected return over time.

- Understanding the key market factors that determine mortgage rates. Source: rocketmortgage.com

Market factors that influence mortgage rates, including Federal Reserve policy, inflation, 10-year Treasury yields, and investor demand for mortgage-backed securities

The Federal Reserve plays a significant role in shaping mortgage rates through its monetary policy decisions. While the Fed doesn’t directly set mortgage rates, its federal funds rate—what banks charge each other for overnight loans—creates a ripple effect throughout all interest rate markets. When the Fed raises or lowers this benchmark rate to control inflation or stimulate economic growth, mortgage rates generally follow the same trajectory, though not always immediately or proportionally.

Inflation and the 10-year Treasury yield are particularly powerful drivers of mortgage rates. Lenders must ensure that mortgage rates exceed inflation; otherwise, they would effectively lose money on loans. Similarly, the 10-year Treasury yield serves as a key indicator for mortgage rates because most 30-year mortgages are paid off or refinanced within a decade. When investors demand higher yields on these government securities due to inflation concerns or economic uncertainty, mortgage rates typically rise to remain competitive in the investment marketplace.

- Current mortgage rates categorized by credit scores, illustrating their impact. Source: finance.yahoo.com

Personal factors affecting individual mortgage rates, such as credit score, down payment size, property type, and loan term

While market conditions establish baseline mortgage rates, your personal financial profile significantly impacts the specific rate you’ll be offered. Your credit score stands as one of the most influential factors in determining your mortgage rate. Lenders view this three-digit number as a snapshot of your financial responsibility—higher scores (typically above 740) qualify for the best mortgage rates because they suggest lower risk to lenders. Even a 20-point difference in your credit score could translate to a meaningful change in your interest rate.

The size of your down payment also considerably affects your mortgage rate. A larger down payment reduces the lender’s risk because you’re financing a smaller portion of the home’s value. For instance, putting 20% down instead of 5% could lower your interest rate by 0.25% or more. Additionally, property type matters—primary residences typically receive lower rates than investment properties or vacation homes, as borrowers are more likely to prioritize payments on their main residence during financial hardships.

- Potential signs of mortgage rates rising to 7% amid various economic indicators. Source: finance.yahoo.com

Economic indicators and global events that impact rate trends, including employment data, housing market conditions, and international financial markets

Employment data releases, particularly the monthly jobs report, can cause significant movement in mortgage rates. Strong employment figures typically push mortgage rates higher as they signal economic strength and potential inflation, while disappointing job numbers might lead to lower rates. Housing market conditions also play a crucial role—when home sales are robust and prices are rising, lenders may feel comfortable charging higher mortgage rates due to increased demand. Conversely, a sluggish housing market might prompt lenders to offer more competitive interest rates to stimulate lending activity.

Global economic events and international financial markets frequently cause shifts in mortgage rates that might seem disconnected from domestic conditions. For example, political instability or economic crises abroad often trigger a “flight to safety” among international investors, who purchase U.S. Treasury bonds as safe havens. This increased demand for Treasuries pushes their yields down, which can subsequently lower mortgage rates. Similarly, international trade tensions or major policy changes by foreign central banks can influence investor behavior in ways that either raise or lower the best mortgage rate available to American borrowers.

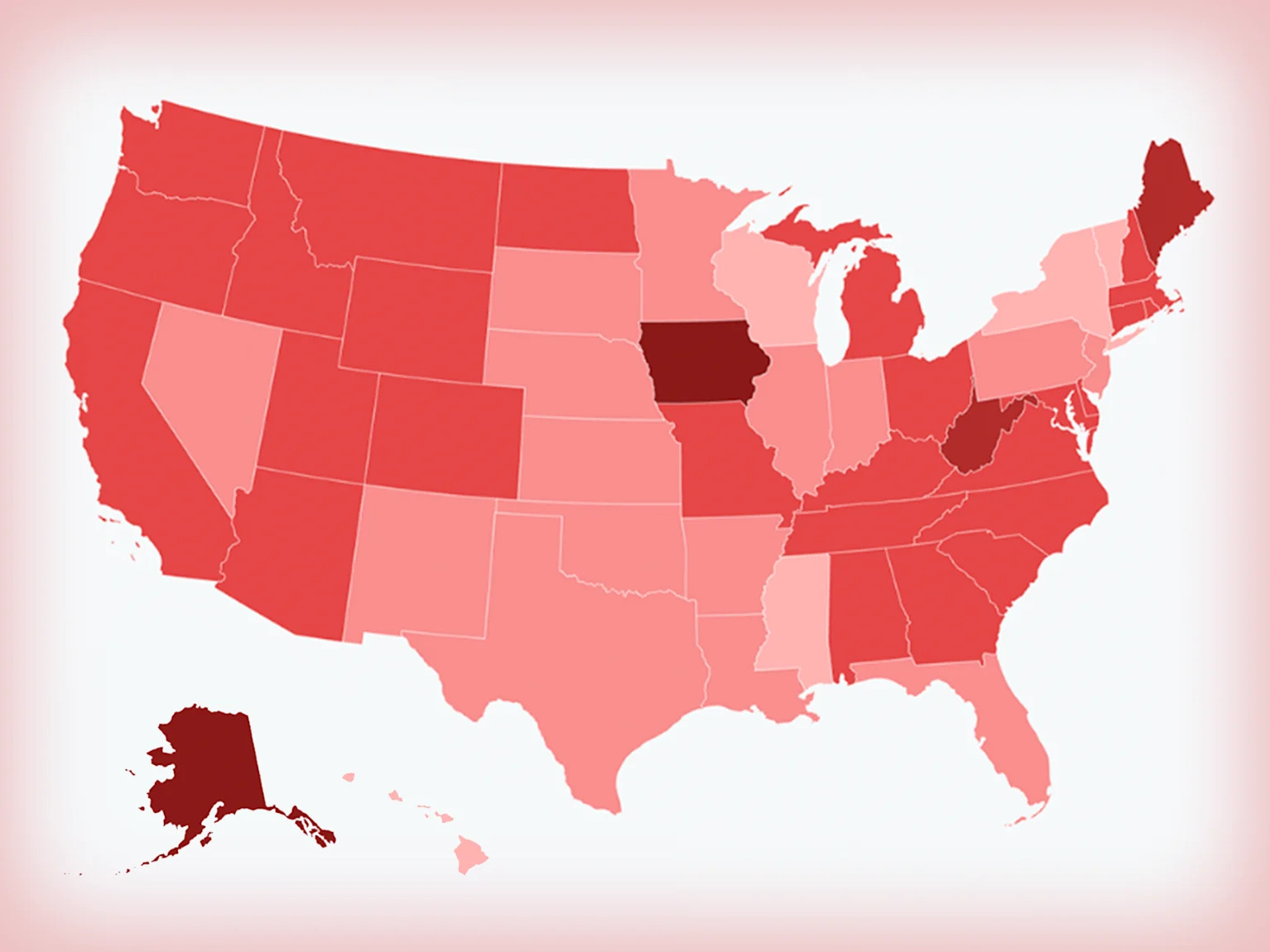

- Average mortgage rates by state, highlighting regional differences. Source: finance.yahoo.com

Strategies for securing better mortgage rates, including comparing lenders, improving credit scores, buying mortgage points, and timing your application strategically

One of the most effective strategies for securing a favorable mortgage rate is to shop around and compare offers from multiple lenders. Research consistently shows that borrowers who obtain quotes from at least three different lenders can save thousands of dollars over the life of their loan. Each lender has different overhead costs, risk assessment models, and profit margin requirements, which results in varying interest rates even for the same borrower profile. Additionally, improving your credit score before applying can yield significant savings—paying down existing debt, correcting errors on your credit report, and avoiding new credit applications in the months before seeking a mortgage can all help boost your score.

Strategic timing of your mortgage application can also impact the rate you receive. While it’s difficult to perfectly time the market, being aware of upcoming Federal Reserve meetings or significant economic data releases might help you lock in a better mortgage rate. Buying mortgage points—prepaid interest that lowers your rate—can be worthwhile if you plan to stay in your home long enough to recoup the upfront cost through monthly payment savings. Finally, consider the loan term carefully; while 15-year mortgages typically offer lower interest rates than 30-year terms, they come with higher monthly payments. Balancing your immediate budget constraints with long-term interest savings is crucial when determining which mortgage product offers the best value for your specific situation.